If you’re wondering how to research stocks, there are a few steps you can take. First, you need to determine whether you want to do all the heavy lifting yourself, or if you want to use other strategies. Other investment methods include exchange-traded funds, mutual funds, or robo-advisors. Decide which approach suits your time, energy, and enthusiasm. After all, it’s your money!

Over the past several years, the value of cryptocurrencies has increased significantly, making them one of the world’s most important classes of digital assets. As a result, more people are exploring the world of cryptocurrencies. But for many others, the dangers involved with cryptocurrency trading continue to be a barrier. At this point, the Bit Index AI application assumes a prominent role and promises to offer a simple method of accessing the lucrative crypto markets. In order to evaluate the markets and give real-time market data to assist traders make wise trading decisions, the Bit Index AI app makes use of a wide range of technology. Open a free account on the official Bit Index AI website to begin using the Bit Index AI app. The Bit Index AI app also features a web-based interface, which is usable on all popular mobile and desktop platforms and is available with full functionality. Thus, you may trade cryptocurrencies from any location and using any computer or device. Although the crypto markets provide a wide range of opportunities, it is important to keep in mind that these digital assets are naturally volatile, making trading them comparatively risky. To trade cryptocurrencies more precisely, traders might use the Bit Index AI program as a guide. It offers customers insightful data-driven research and insights that can support their ability to make quick trading judgments. Despite the advantages of the Bit Index AI software and the dangers associated with trading cryptocurrencies, we advise taking the time to evaluate your knowledge and expertise before you begin.

Fundamental analysis

While technical analysts often argue against the use of fundamental analysis, it is often the most effective method for researching stocks. Fundamental analysis looks at a company’s fundamentals and uses that information to guide investment decisions. Technical analysts, on the other hand, trade on momentum. The data for a fundamental analysis is often years old, rather than weeks or days. Fundamental analysis often yields better results because fundamentally focused investors tend to wait a long time before their investment’s intrinsic value reflects in the market. This method assumes that investors aren’t taking advantage of any stock price jumps, but rather that the stock price drops as a result of an underlying problem. The efficient market hypothesis contrasts the two methods, claiming that technical analysts and advocates of the efficient market hypothesis cannot consistently beat the market.

There are two main types of fundamental analysis: quantitative and qualitative. The former involves using public data to determine a stock’s value, while the latter makes use of historical performance ratios. Both quantitative and qualitative fundamental analysis are useful for identifying which stocks are likely to increase in value in the future. You can apply quantitative and qualitative fundamental analysis to a company’s financials, including its earnings per share, EPS, and debt levels.

Technical analysis

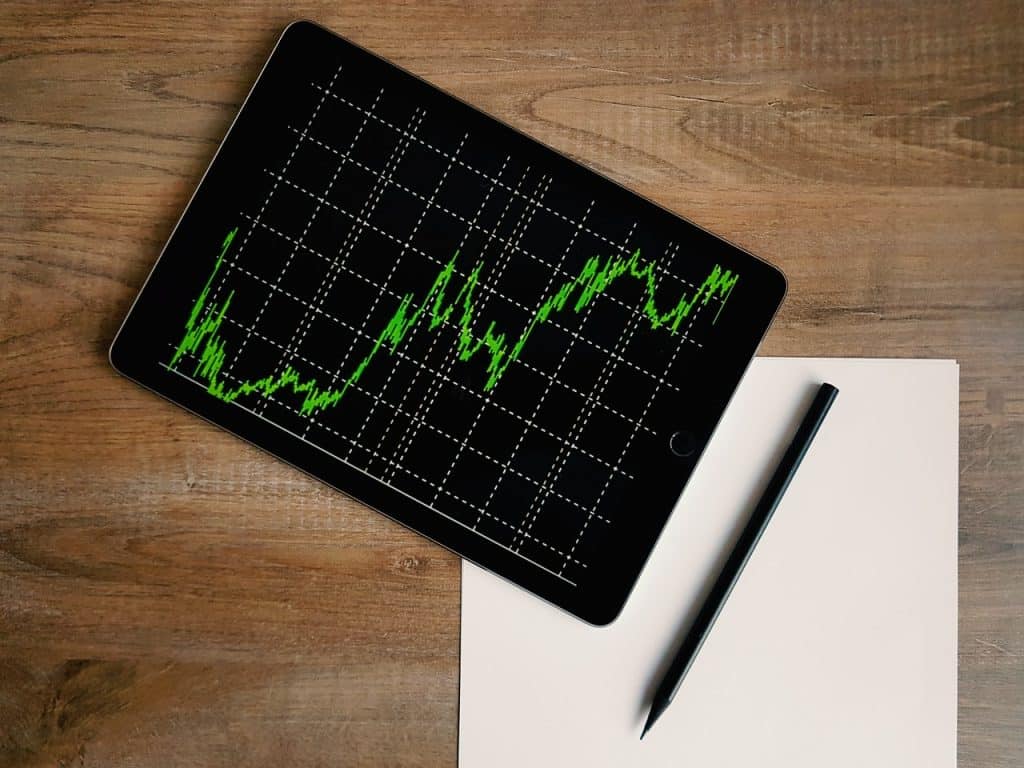

Using technical analysis to invest in stocks can be extremely profitable if you know how to read charts. These charts give you information about the past price behavior of stocks. They also give you a basis for inferring what price behavior is likely to be like in the future. There are three basic types of charts: bar charts, line charts, and candlestick charts. Charts are typically drawn on a linear scale, although you can also use a logarithmic scale if you’re looking at data moving in large ranges. Volume is also an important element of technical analysis, as it confirms previous movements and signals potential price moves.

In general, the concept of technical analysis is to trade with the trend. If indicators are showing that a security is headed upwards, buy. Conversely, if you see that the security is headed down, sell. This doesn’t mean that you should sell or buy until you understand more about it. Ultimately, if you trade before you know what you’re doing, you risk missing out on an opportunity to build your capital.

Price-to-earnings ratio

When researching stocks, you might want to pay attention to the Price-to-earnings (P/E) ratio. This metric gives investors an idea of how much a company’s shares are worth when earnings per share are $1. As a result, it’s an excellent way to evaluate stocks quickly and easily. Here are a few tips to keep in mind when evaluating stocks with a P/E ratio.

First, the P/E ratio is a useful tool to compare the price of a stock to its profits. You can find an affordable stock by comparing its P/E to other companies’ earnings per share. The price-to-earnings ratio is calculated by taking the current stock price and dividing it by the company’s earnings per share for the previous year. Earnings per share is the total net profit of the company over the last year, divided by the number of outstanding shares.

Long-term potential of a company

Fundamentals refer to the financial performance of a company and provide information on its revenue, profitability, assets, liabilities, and growth potential. Fundamental analysis is useful for individual investors when they are looking for a stock that is undervalued and has long-term potential. Financial information on publicly traded companies can be found on investor relations pages. When analyzing a company’s fundamentals, you should focus on the long-term growth potential of the company.

Once you’ve decided to invest in a particular company, you need to figure out whether it’s a good long-term bet or not. It’s helpful to use stock prices to compare companies, and understand who the company’s leadership team is. The leaders of a company’s board of directors and CEO are usually the ones who can make or break a company’s stock price.